home equity loan texas bad credit

This is a measure of how much you owe compared to the value of the home. Texas Bad Credit Loan Texas Mortgage Center Texas Mortgage center offers custom solutions including pre-qualifications for every residential Texas home loan situation including loans for people with bad credit.

Get A Home Equity Loan With Bad Credit Lendingtree

If you need money and have bad credit it may be worth considering alternatives to a HELOC.

. Home Equity Loan Texas Home Equity Loan Texas We are most-trusted loan refinancing company. With our help you can save your time and money when buying a home or refinancing your mortgage. Call us at 877 280-4833 for more information on how to get a Texas Cash Out loan.

Home equity loans in Texas and Houston TX area provided by TheTexasMortgagePros - the best Texas mortgage broker offering the lowest rate and fee for your home loan needs. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line amounts. Help You Find the Best Utility of Home by Dina WilsonHome is one of the preferred assets by the financial marketYou can have always greater chances when you are wishing to put your home against the loan.

Bad Credit HELOC Loan Options 5 or 10-year draws Interest Only Home Equity Line of Credit for Poor Credit. Many Texas services will however grant a person in this. Home Equity Loans Rates are based on a fixed rate home equity loan for an owner occupied residence second lien 10 year or 15 year repayment terms with an 80 loan-to-value ratio for loan amounts of 50000 or 50000.

The OCCC is located at 2601 N. However having a bad credit score reduces your approval chances. A traditional home equity loan is a one-time loan that uses your homes equity as collateral.

The plan includes not just traditional mortgages but also home equity lines of. Even if a Texan has a home worth 100000 and 100000 in equity the most he could possibly borrow against it would be 80000. Having bad credit means that you will pay a higher rate than the average borrower.

And even if youre able to get approved for a home equity line of credit with bad credit it will likely cost you more. If you have bad credit you may still be able to get a. Lamar Boulevard Austin Texas 78705.

This price is mainly in the form of interest. While home equity loans use your homes equity as collateral youre not limited to housing-related purchases. General questions about Texas home equity lending laws can be directed to the Office of Consumer Credit Commissioner OCCC which regulates the credit industry in Texas.

Payments do not include amounts for taxes and insurance premiums. Even though getting a home equity loan with bad credit in Texas is easy there will be a price to pay. A home equity line of credit HELOC also uses your equity as collateral but credit lines can be used over and over again.

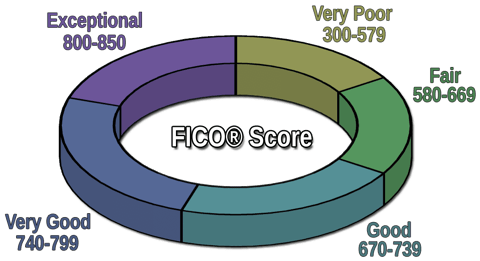

But if you have bad credit FICO score below 580 you could have a tough time. Once you receive the lump sum you wont be able to borrow any more. Compare home equity line of credit rates in Texas.

Once your home equity loan is approved the process is similar to getting a regular mortgage. Texas law limits home equity loans and lines of credit to 80 loan-to-value LTV. If you select a home equity loan youll get one set lump sum of money that youll repay over time via fixed monthly payments.

These loans are specifically designed for first time home buyers and offer many attractive benefits including the lack of a minimum credit requirement a lower down payment and more lenient debt and income requirements in general. If youre a first time home buyer in the state of Texas and you have bad credit you should consider applying for an FHA home loan. But with the time you now may need a faster approval that is usually absent with such loans.

One of the most popular bad credit loans in Texas is the Option payment program. For example the current rate on Texas home equity loans averages 816 percent. The nations leading reverse mortgage provider is expanding into traditional home loans to help seniors who want an.

Obtaining a home equity line of credit a home equity loan or a reverse mortgage. Fixed Rate Home Equity Loans for Low Credit 10 15 20 25 and 30-year options BD Nationwide connects consumers with lenders that extend financing solutions for borrowers who have fico scores between 500 and 600. Can I Refinance With Bad Credit A Step-by-Step Guide to Auto Refinancing with Bad Credit For example those that took out a bad credit auto loan.

The option payment program interest only loan has loan rates starting at 195 and is a great loan program for people with bad credit. Knowing the differences between these types of equity will help you decide which is best for you and may. Data provided by Icanbuy LLC.

A home equity loan can be a great way to borrow money at a low cost to fund home improvements or consolidate debt. A home equity loan hel is a type of loan in which you use the equity of your property texas veterans home loans bad credit or a portion of the equity thereof as collateral. Borrowers looking to obtain home equity financing generally have access to two options.

Click here for more information on rates and product details. An online home equity loan comparison tool saves you time by allowing you to enter your information and get calls from lenders who compete for bad credit home equity loans. Home equity loans in Texas.

A home equity loan for bad credit is provided by a lender that specializes in helping borrowers with bad credit. However the majority of people will not get the maximum loan. Home Equity Loan Online.

A Texas home equity loan has an 80 percent loan to value LTV limit. At CUTX the minimum home equity loan amount starts at 7500000. If youre a first time home buyer in the state of Texas and you have bad credit you should consider applying for an FHA home loan.

Texas Home Equity Loan. If you have 20 equity in you home and have bad credit it is possible to have rates as low as 195 fixed for one year. The two main options to tap into your equity in Texas include home equity loans and home equity lines of credit HELOC.

Home equity loans allow property owners to borrow against the debt-free value of their homes. Bad credit can make it difficult to get a home equity line of credit even if you have plenty of equity in your home. If youre approved for a loan a lower credit score can cause lenders to give you less favorable terms such as home equity loan rates.

Provide your documents and close your home equity loan. Remember if you need a new Texas home loan or a Texas home equity loan and you have bad credit we will tailor a bad credit.

Can You Get A Home Equity Loan With Bad Credit Alpine Credits Ltd

Qualifying For A Home Equity Loan With Bad Credit Lendedu

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

7 Best Home Equity Loans Of 2021 Money

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Equity Loan If You Have Bad Credit Nerdwallet

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity And Heloc Loans Complete Guide

Can I Get A Home Equity Line Of Credit With Bad Credit Credit Karma

Requirements For A Home Equity Loan Or Heloc In 2022 Nextadvisor With Time

Can You Get A Home Equity Loan With Bad Credit Alpine Credits Ltd

Can You Get A Home Equity Loan With Bad Credit Alpine Credits Ltd

What You Need To Know About Home Equity Loans Credit Com

How To Get A Bad Credit Home Loan Lendingtree

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Loan For Bad Credit Home Equity Loan Home Equity Loans For Bad Credit