interest tax shield example

Cash outflow in year 2. Lets take a simple example to apply the above formula.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

The company provides a 10 depreciation on the straight-line method.

. In such a case the tax shield is. Income tax deductibility tax shield Interest is a reduction to net income on the income statement and is tax-deductible for income tax purposes. To calculate the value of the interest tax shield you may use this interest tax shield calculator or estimate the value manually as we.

Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate. Such a deductibility in tax is known as. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

Apple is a well-known example of this. This companys tax savings is equivalent to the interest payment. Interest Tax Shield Calculation Example ABC Ltd.

Suppose company X owes 20m of taxes pays 5m. This companys tax savings is equivalent to the interest payment. This is usually the deduction multiplied by the tax rate.

For instance if your allowable interest tax cost is. A companys interest payments are tax deductible. If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity.

That is the interest expense paid by a company can be subject to tax deductions. Interest Tax Shield Calculation Example Terminal scrap value of 20000 is realizable if the asset is purchased. Tax_shield Interest Tax_rate.

Tax Shield Deduction x Tax Rate. Interest Tax Shield Example. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Interest Tax Shield Tax-Deductible Interest Amount Tax Rate. A Tax Shield is an allowable deduction from taxable income that. Cash Outflow in Year 1 Annual repayment Depreciation tax shield Interest tax shield.

Basically the company uses two main tax shield strategies. However issuing long-term debt accelerates interest. 12063 30000 333 35 30000 10 35 7513.

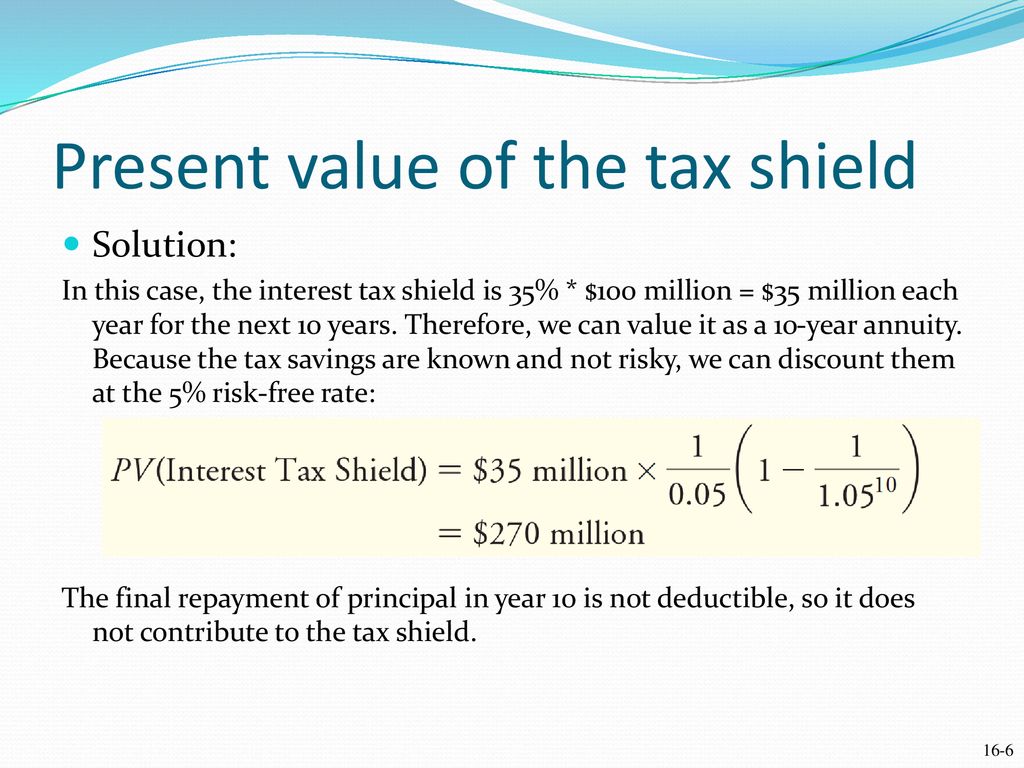

This tax shield example template shows how interest tax shield and depreciated tax shield are calculated. Interest Tax Shield Interest expense Tax Rate. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Interest Tax Shield Example. The effect of a tax shield can be determined using a formula.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a tax rate of 15. Despite having a cash pile of nearly 35 billion in September 2021 the company carried long-term debt of about 162 billion.

You can use the following formula to calculate the interest tax shield. The value can be calculated by the interest expense multiplied by the companys tax rate. The impact of adding removing a tax.

The value of these shields depends on the effective tax rate for the corporation or. Thus there is a tax savings. So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240.

Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG. Is considering a proposal to acquire a machine costing 110000 payable 10000 down and balance payable in 10 equal installments at the.

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula How To Calculate Tax Shield With Example

Out Of The Perfect Capital Market Role Of Taxes Ppt Download

Adjusted Present Value Apv Formula And Calculator

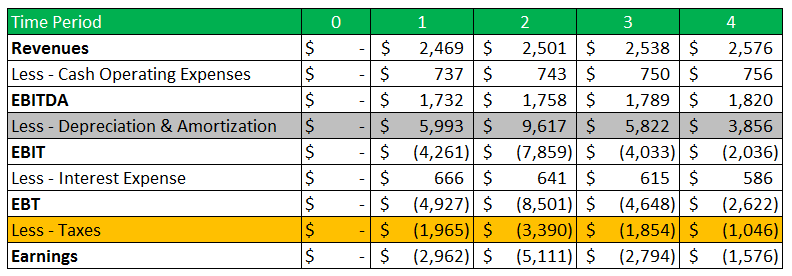

Berk Chapter 18 Capital Budgeting Leverage

Pdf Is Tax Shield Really A Function Of Net Income Interest Rate Debt And Tax Rate Evidence From Slovak Companies

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Interest Tax Shield Formula And Calculator

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Capital Structure Theory Under Three Special Cases Ppt Video Online Download

The Effect Of Gearing Week Ppt Video Online Download

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

What Is A Tax Shield Depreciation Tax Shield Youtube

Depreciation Tax Shield Formula Examples How To Calculate

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Risky Tax Shields And Risky Debt An Exploratory Study

Using Apv A Better Tool For Valuing Operations

What Is The Present Value Of The Interest Tax Shield Chegg Com

:max_bytes(150000):strip_icc()/TaxShields-e5772ea9128142eda7f291daeb3c4c0a.jpeg)